Recognition is here to stay in Finance Facial

| Recognition is here to stay in Finance Facial |

AI-fuelled computer vision technology is disrupting financial services. The online banking growth has had a transformative impact on how people are managing their financial accounts and making payments. The increasing sophistication of fraudulent transactions and virus attacks can cost financial organizations millions of dollars, loss of data and customer confidence, and negative brand reputation. One potential solution to this problem is facial recognition technology, a process of identifying or verifying the identity using face in photos, video, or in real-time. Let’s take a closer look at some facial recognition approaches applied these days.

Facial Recognition Approaches

Below we have proposed some methods to improve facial recognition accuracy rate.

- Classical Approach. It is not effective when working with combined pose, occlusion and illumination variations. Developers usually apply it when working with small data assets. This approach involves handpicking features by using domain knowledge data. Then with the machine learning algorithm, it is classified.

- Modern Approach. It works on large data sets, effective when working with the combined pose, occlusion, and illumination variations. In this approach, artificial neural networks are used. Facebook’s DeepFace and Google’s FaceNet use this approach.

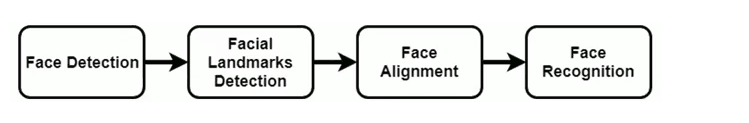

Below you can see a high-level block diagram of a face recognition system. Pre-processing step includes the following steps:

- Face detection.

- Facial landmarks detection.

- Face alignment.

All these steps are important to identify individual face correctly.

In the face detection stage, the system detects whether there is a face in the image or not, identifies landmarks within facial images, face alignment. Then deep learning techniques are applied to recognize the person’s identity.

Recent advances in deep learning technology have increased face recognition accuracy to incredible levels. Financial organizations can use AI-powered computer vision tools to stay in compliance and identify fraud. For example, IPSoft’s Amelia uses natural language processing to scan legal and regulatory text for compliance issues. With Onfido’s platform utilizing various open to public databases, employers can get a quick identity verification and background checks for things like the criminal and driving records. Cofirm.io automatically proves consumer identity documents.

Bottom line

Moving toward AI-powered computer vision software within financial organizations will require building the right framework to leverage the technology and securing the right tech partner to bring the project to life. We, at Provision Lab, have a team of professionals who can deliver great computer vision solutions for your business in finance.

Комментарии

Отправить комментарий